Here’s our latest take on what’s driving these price movements and why investors should keep an eye on this asset class.

Chart 1: Gold prices in selected currencies, 2017-2022

Seven key drivers of gold prices

- Gold, inflation, interest rates. Gold is seen as a "real asset" and is expected to retain its value in the face of rising inflation. This may reflect the metal’s long history as a currency, but it’s also linked to its relatively constant supply (it doesn’t corrode, but new sources are limited and known).

That said, even if its value is "real," it’s an asset that pays no interest. Indeed, it could be argued that it’s an asset with an ongoing negative interest rate when you factor in the costs associated with storage and insurance.

These two characteristics suggest that bullion prices should respond to changes in expectations around interest rates and inflation. This has held true for much of the past three years (Chart 2).

Chart 2: Gold price in US$ and US real interest rates, 2003-2022

- Gold and the dollar. In global markets gold is quoted and traded in dollars. The historic relationship between gold and the currency normally holds that prices struggle when the dollar is strong. This has certainly been the case this year as the dollar surged,1 buoyed by rising interest rates and investors’ perception that the US Federal Reserve2 will be forced to continue raising rates.

- Demand for physical gold as an investment. This demand has been rising steadily over the past few years. For example, the UK’s Royal Mint recently reported that demand for Britannia bars has increased dramatically.3 Meanwhile, total gold assets held within physically backed exchange-traded bullion funds (gold ETFs) have risen to more than 100 million ounces (Chart 3).

Chart 3: Known ETF holdings of gold, 2012-2022

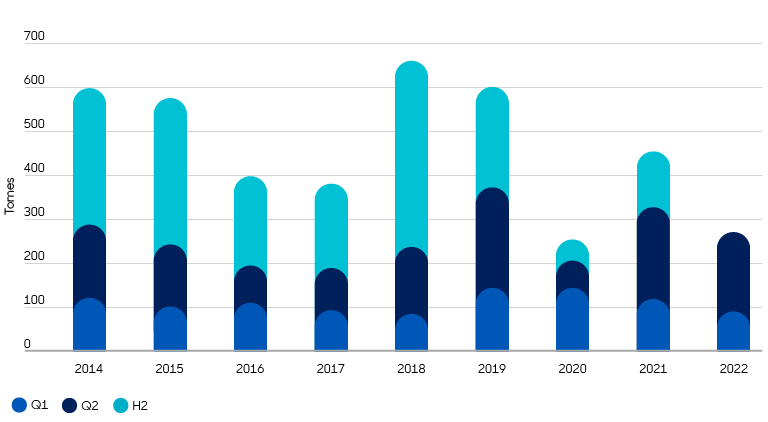

- Gold purchases by central banks. Central banks have been keen to diversify their holdings away from fiat currencies such as the dollar and euro. Indeed, over the first half of this year central banks were responsible for some 270 tons of net gold purchases, building on a multiyear trend (Chart 4).

- Traditional jewelry demand. This has accounted for up to 50% of gold demand in normal years4 but fears of troubled times ahead may prove to be a headwind, at least in the short term. Most of this demand comes from India and China, where people buy physical gold as a reliable store of value for historical and cultural reasons. Continuing lockdowns in China will clearly curb demand. Meanwhile, a recent increase in Indian import taxes to 12.5%5 may have also had a dampening effect.

- Gold production. Output was impacted by Covid disruptions and contracted over the course of 2020 before recovering last year. In fact, in the first half of this year, gold supply has risen 5% year-over-year thanks to record mine production.6 However, with supply chain disruptions and increased energy costs, investors may be monitoring whether supply can keep pace with demand.

There are few new projects coming on-stream, given the lack of investment over the last decade. In addition, with lower ore grades – the amount of gold that can be extracted from each tonne of rock excavated — it’s hard to see a near-term increase in primary output.

- Scrap and recycling. Activity is usually elastic and driven by the price of gold. However, we’ve seen a strong response to higher prices with first-quarter data showing the highest levels of recycling since 2016.7

Why should investors care?

Gold has played, and could play a useful role as a diversifier in a portfolio. The precious metal provided protection during previous periods of stagflation, although more recently, rising interest rates have dampened its appeal (due to the opportunity cost of holding gold versus other assets).

In fact, the current appetite in terms of investment demand may be partly based on investor desire to preserve real purchasing power and protect against the risks of currency devaluation. Gold has also often simply been seen by investors as a “safe haven” asset in times of turmoil.

There are therefore many questions to consider that will have an impact on where gold prices head from here, including:

- What will happen to interest rates?

- What's the future of inflation?

- How will current tensions around the world play out?

This is a complex mix. The number of potential outcomes this time would suggest that gold is likely to remain part of the solution for many.

1 CNBC, “Gold hits more than 2-year low on dollar strength, Fed concerns,” September 22, 2022.

2 US Federal Reserve – the central banking system of the United States of America 3 Kitco, “Royal Mint sees record bullion demand from American investor,” February 14, 20224 World Gold Council, “Gold Demand Sectors,” 2022.

5 Bloomberg UK, “India Raises Gold Import Tax Amid Trade Deficit, Rupee Low,” July 1, 2022.

6 Gold.org, “Gold Demand Trends Q2 2022,” July 28, 2022. 7 Ibid

IMPORTANT INFORMATION

The statements and opinions expressed are those of the author and are as of the date of this report. All information is historical and not indicative of future results and subject to change. Reader should not assume that an investment in any securities and/or precious metals mentioned was or would be profitable in the future. This information is not a recommendation to buy or sell. Past performance does not guarantee future results.

Trading in commodities entails a substantial risk of loss and is not suitable for all investors.

View prospectuses for abrdn precious metals funds on Scribd

Projections are offered as opinion and are not reflective of potential performance. Projections are not guaranteed and actual events or results may differ materially.

ALPS Distributors, Inc. is the marketing agent.

There are risks associated with investing including possible loss of principal.

ALPS is not affiliated with abrdn.

ETF001920 9/6/23

US-230922-181045-1