Escalation of the Russia-Ukraine conflict has increased near-term risks for the inflation outlook. While energy supply constraints will have the biggest impact, there are also risks to broader supply-chain disruptions. Ultimately, the longer conflict persists, the greater the spillovers into global inflation.

Semiconductor shortages and international shipping delays have been the two most important supply constraints on goods production since the start of the pandemic. These so-called "intermediate goods and services" feed into the production and delivery of a much wider array of products, affecting their prices.

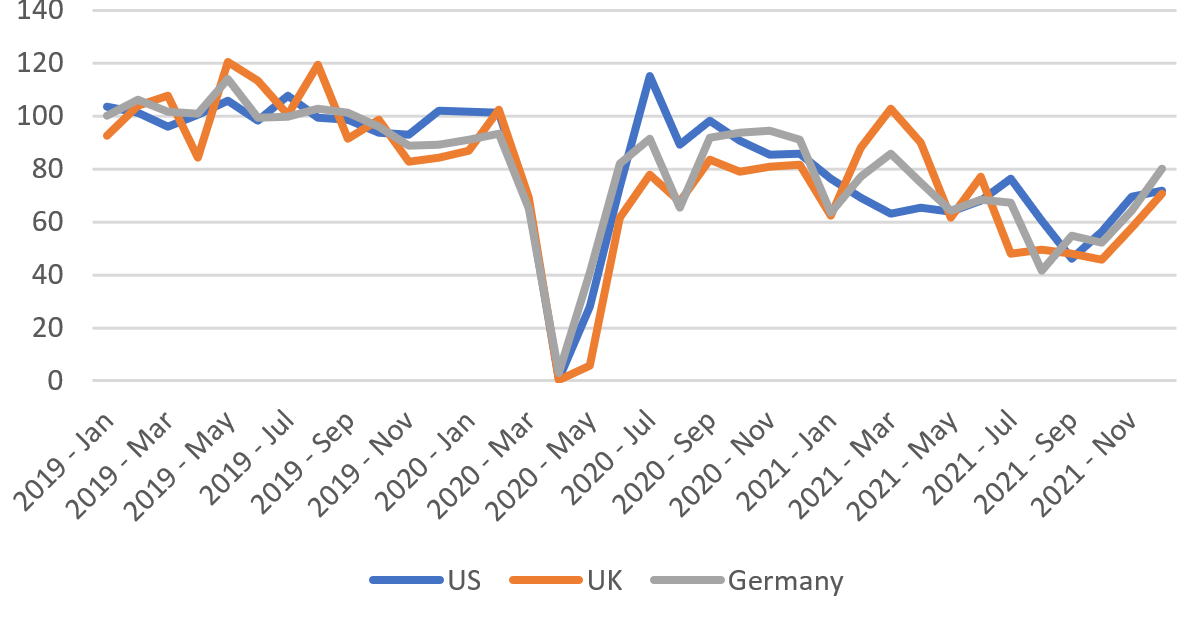

Green shoots of recovery across supply chains had become evident as early as October last year. Freight and container costs stabilized and production across key sectors started to improve. With the emergence of the Omicron Covid variant, however, delays returned briefly.

The Russia-Ukraine conflict poses fresh risks to inflation. While the impact across rail and shipping routes are predominantly in Europe, supply disruptions to raw materials will have global spillovers.

Near-term disruptions to energy and food supply

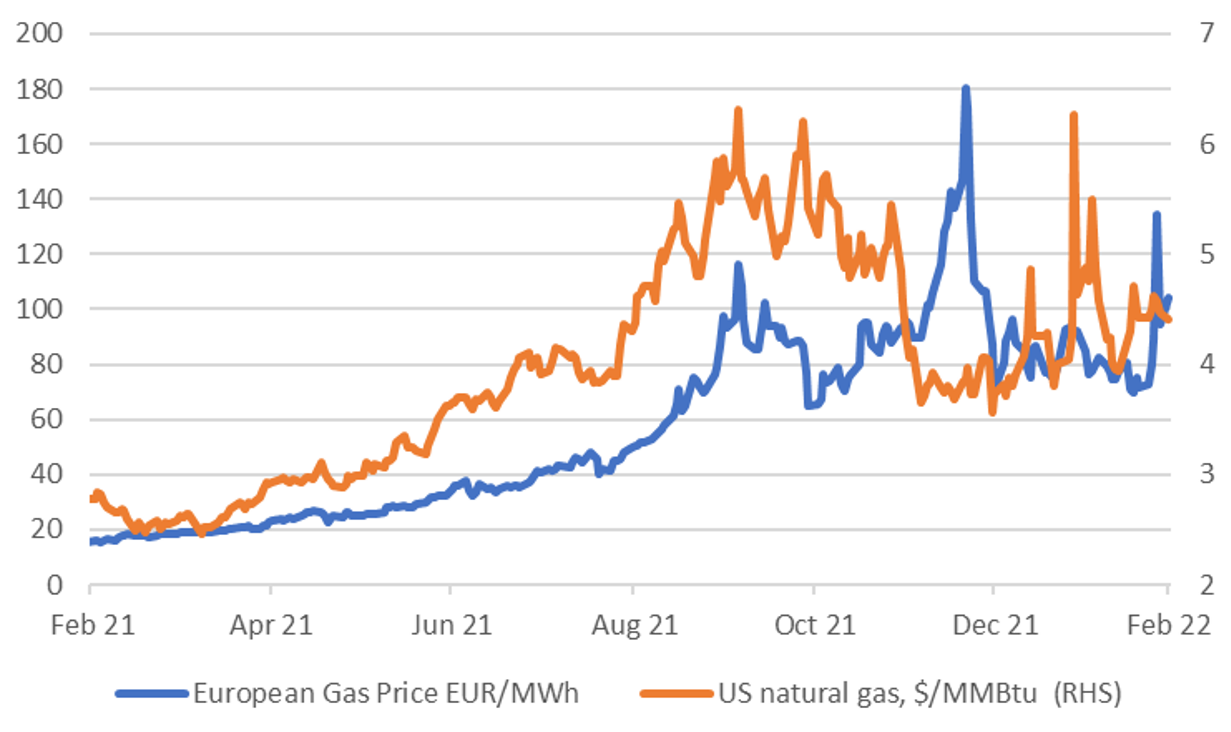

Europe remains most exposed given the heavy reliance on Russian gas supply through Ukraine. While other economies have more diversified sources of energy, elevated commodity and raw material prices will still feed into global wholesale electricity costs and filter into core goods prices, lifting global inflation.

Historically, geopolitical episodes have triggered temporary price spikes in commodities that swiftly unwind. There is scope for some offset from the coordinated release of strategic reserves, or an increase in production from other Organization of Petroleum Exporting Countries (OPEC) members, however, crude oil could still easily reach $125-$150 per barrel.

There are also increasing steps toward energy sanctions. The UK government is pushing to include all Russian banks within the SWIFT measures, which would result in an embargo on Russian fossil fuels. Meanwhile, the private sector, including energy giants, have acted to protect reputation risks and have pulled back from doing business with Russian entities. EU leaders may also face public pressure for energy sanctions as civilian casualties rise.

Against the backdrop of strong electricity demand through the northern hemisphere winter, and the lack of long-term energy contracts across parts of Europe, headline inflation is set to accelerate further over the coming months

Against the backdrop of strong electricity demand through the northern hemisphere winter, and the lack of long-term energy contracts across parts of Europe, headline inflation is set to accelerate further over the coming months before base effects are likely to pull inflation lower over the second half of this year.

Food prices are likely to increase because 25% of global wheat supply comes from Russia and Ukraine. Russia is also a key producer of fertilizers such as potash, posing price risks for a broader swath of countries, and potentially lower crop yields over the medium term.

Chart 1: Energy price spikes add to near inflation pressures

Autos and semiconductors face further challenges

Prolonged tensions will eventually impact sectors hardest hit during the pandemic such as autos and semiconductors. Russia accounts for almost half the global production of palladium, a core component of semiconductors. This metal is also critical to the manufacture of internal combustion engine (ICE) vehicles. The fact that electric vehicles (EVs) only accounted for 9% of global autos sales last year, which suggests a continued dependency on ICE vehicles. This means that disruptions to palladium supply could lead to additional headwinds for the auto sector.

Ukraine is a key producer of semiconductor-grade neon gas, required for lithiography process critical for producing chips. While the US chip industry is reliant on Ukrainian supplies, Asia is far more important for influencing the global supply chain and has diversified supplies. This alleviates some of the near-term risks to the global chip supply chain. However, the medium-term outlook for the US plans to develop the industry will be impacted.

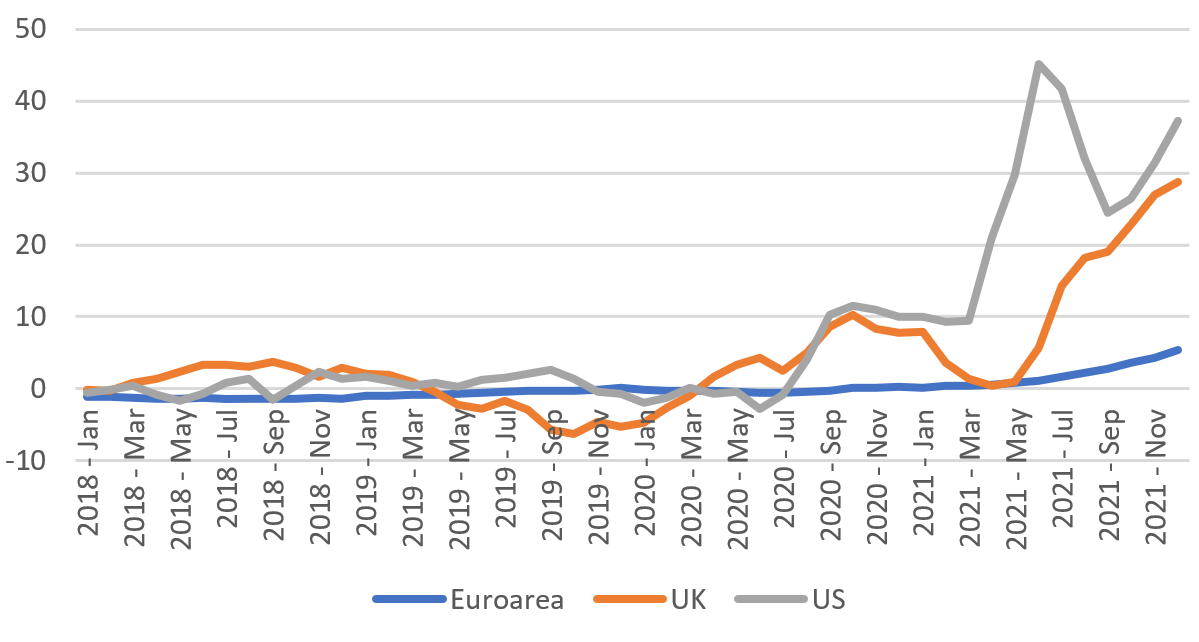

Chart 2: Used car prices remain elevated in US and UK…

Source: Eurostat, ONS, BLS/Haver/abrdn, as of February 22, 2022

Chart 3:… while geopolitics threaten to derail the fourth-quarter recovery in production

Source: ANEWS/SMM/VDA/Haver/abrdn, as of February 22, 2022

A difficult balancing act for policy makers

Central banks have an additional challenge to navigate. Higher prices and risks of energy rationing would weigh heavily on consumers and industrial activity increasing recession risks. Meanwhile, prolonged supply-chain disruptions increase the risk of inflation expectations rising significantly. Behavioral changes could fuel inflation as workers demand higher wages and firms pass wage costs through to prices.

In those countries such as the US and UK, where demand has been very strong and underlying inflation pressures have been more acute, we expect central banks to prioritize inflation over demand destruction and push ahead with policy tightening. In fact, in the US, the Federal Reserve (Fed), has already introduced the first of a series of planned interest-rate hikes. However, for some others, financial conditions and uncertainty may dominate the policy decision in the near term.

Longer-term challenges ahead

The inflationary impact will likely fade over time, but there may also be a shock as the cost structure is pushed permanently higher. This adds to our concerns about the supply-side constraints that weigh on the global recovery. More persistent price increases in the goods sector would provide another headwind for consumer spending, creating a challenging backdrop for central bank policy.

From a long-term perspective, the global community has some big questions to answer. Firstly: How to diversify energy supply and production chains? Pressure to accelerate investment in alternative energy sources will intensify. Semiconductors that are now such an essential component in so many goods, investment and reshoring to protect production chains will become a priority.

Another issue is the need to address investment requirements across transport networks — physical infrastructure and workforce — to attract, train and retain staff across key jobs that suffer from poor public perceptions.

US-300322-168460-1