Climate scenario analysis

Back in February, we released our 2020 climate scenario analysis. That study helped us answer many of the questions that surround the investment implications of climate transition and physical risk.

It also established a critical new way for us to integrate climate-related risks and opportunities into our investment processes and client solutions.

Scenario analysis involves modelling the effect of different climate outcomes – including different climate policies and alternative technology development paths – on asset prices. Each scenario is assigned a probability to help investors make better decisions.

How is our analysis different?

We’re very proud of our climate analysis approach because, unlike those used by many fund managers, it’s not a standard ‘off-the-shelf’ solution.

Instead, we tailor it to make more nuanced assumptions and to review more climate scenarios. It can also be updated to take into account changes in policy, technology and the structure of markets, as well as how companies are adapting.

Time for an update

Our framework allows us to take the latest factors into account in the design of scenarios which can be used in making investment decisions.

In the first part of our climate scenario analysis update, we look at the evolving factors that shape the scenarios and how the scenarios have changed in a Covid-degraded world.

Key 2021 climate scenario analysis takeaways

Expect lower energy demand because of slower post-Covid growth in many countries.

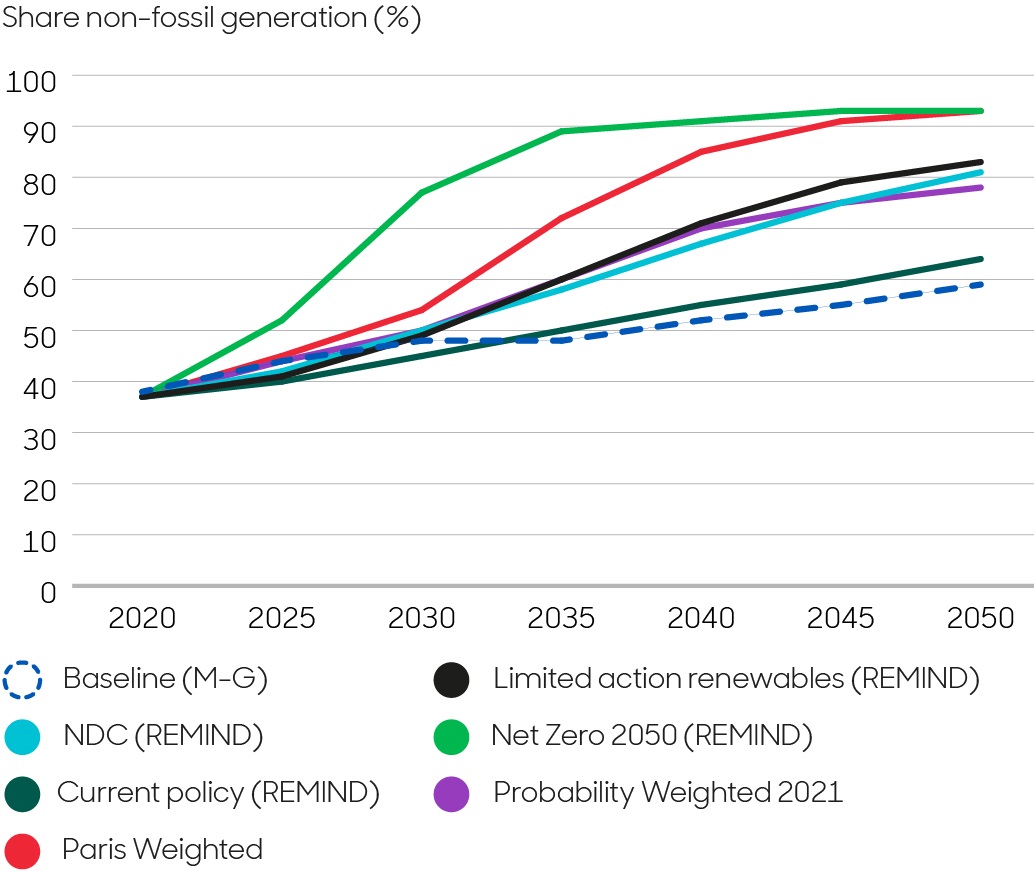

Renewable technologies are gaining market share even more quickly in power and transportation.

Ambition and credibility of climate policy commitments are improving but still fall short of aligning with the objectives of the Paris agreement.

How have climate risk drivers changed?

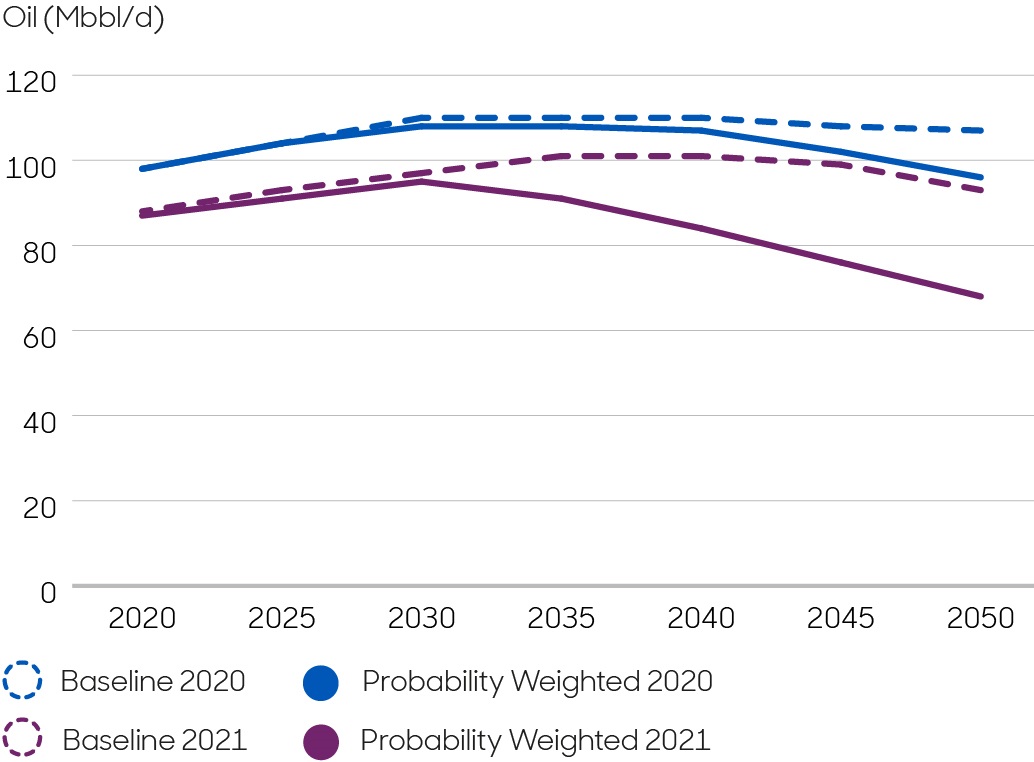

Structural damage caused by Covid has lowered our projections for long-term global economic growth and this has altered regional and sector growth profiles. This, in turn, has reduced our expectations for total energy demand over the longer-term – for both fossil fuels and renewable energy.

That said, the integration of renewable energy in transportation and power has made great progress thanks to tightening regulations and declining relative production costs. Furthermore, assessments of future technological change assume the relative price of renewable technologies to fall further.

<span style="font-size: 14px;">Even though much more needs to be done, the expected speed of global decarbonisation has increased.</span>

Government and corporate climate commitments have steadily become more ambitious. Even though much more needs to be done, the expected speed of global decarbonisation has increased. Policymakers also require banks, insurance companies and pension funds to assess their exposures to a range of physical and climate-transition risks.

The upshot is that markets are pricing in a faster energy transition. We’ve seen valuations for some firms in the utilities, industrial, materials and auto sectors rise especially quickly.

How do the 2021 climate scenarios change?

The baseline scenario – the scenario that reflects what we think is priced into markets and against which all other scenarios are benchmarked – incorporates a moderately faster transition towards low-carbon technologies.

Our models, as well as the markets, have reappraised the outlook for renewable technologies. As valuations for these companies rise, we’ve made some adjustments to ensure energy transition opportunities aren’t overestimated.

Meanwhile, our bespoke scenarios have been adjusted to reflect more ambitious policy environments in some countries, as well as a faster decline in the relative cost of renewable technologies, particularly in transportation.

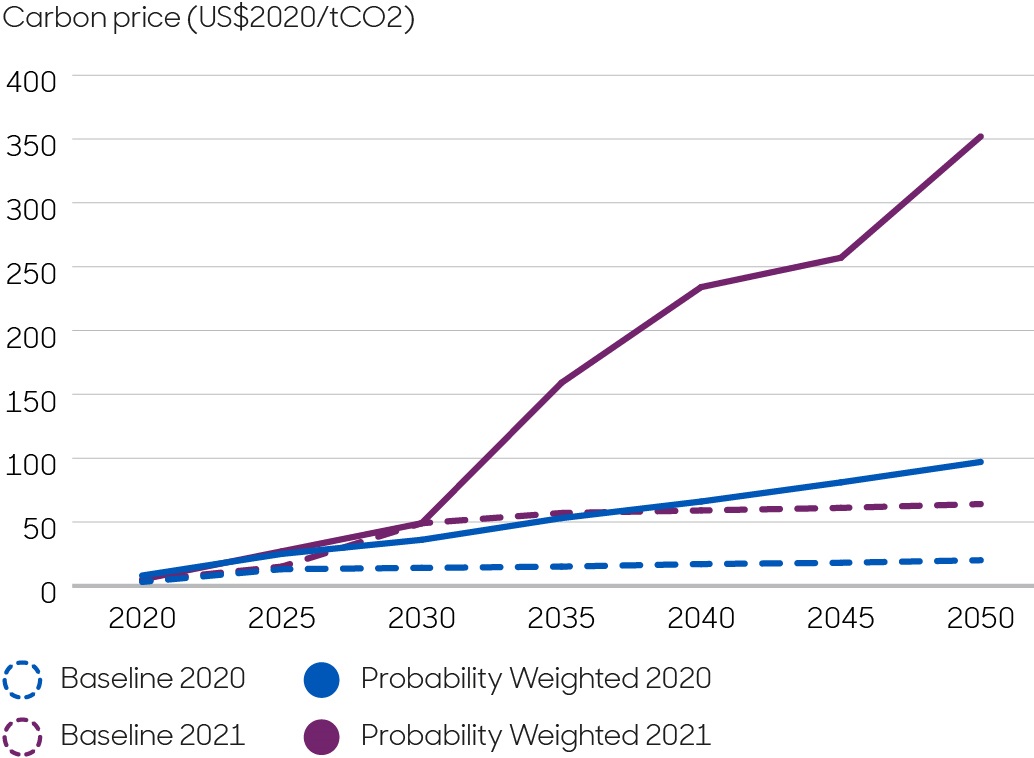

We have also increased the probability of stronger climate action and Paris climate agreement-aligned scenarios. Our mean scenario now sees greater emissions reductions than in our earlier exercise. That said, there’s still a long way to go.

Using NGFS scenarios

We’ve started using off-the-shelf scenarios built by the Network for the Greening of the Financial System (NGFS). NGFS scenarios are used by regulators to assess climate risk exposures for regulated financial entities. Using them makes scenarios easier to compare and so we’ve mapped our earlier scenarios onto the new NGFS scenarios.

The NGFS scenarios incorporate new International Monetary Fund (IMF) projections for long-term global economic growth. These make significant downward revisions to cumulative economic growth forecasts over the next three decades, with some of the largest occurring in emerging markets. This has reduced the forecast size of the energy market.

Solar, nuclear, China

We’re more optimistic about solar photovoltaic (solar panel) use and we’re more pessimistic about natural gas and nuclear use in our baseline scenario. This reflects faster-than-expected increases in solar’s market penetration; the expectation that these trends will continue; and a less favourable outlook for carbon capture and storage (CCS) technologies.

That said, nuclear’s share increases modestly in most scenarios relative to the baseline (rather than decline as it did in our earlier scenarios). Message-Globiom, one of two integrated assessment models we use, shows a decline in the expected role of natural gas as climate action is scaled up. This boosts estimated valuations for utilities with nuclear portfolios.

China’s expanded policy commitments suggest it will likely decarbonise more quickly than the average pace in the rest of the emerging markets. We still think Europe has the highest chance of completing the net-zero transition by 2050, and emerging markets (ex-China) the least. The US won’t lag behind other developed economies as Democrats hold the upper hand in politics for now. But the headwinds to decarbonising the American energy system remain significant.

Our expectations for carbon prices are significantly higher, especially after 2030.