Last year in our paper “Going green within liability-driven investment solutions” we discussed considerations for UK Defined Benefit (DB) pension schemes looking to incorporate green gilts within their liability-driven investment (LDI) portfolios. Since then, two green gilts were issued in September and October 2021, with maturity dates of 2033 and 2053.

This provided the first opportunity for pension schemes to substitute for green within their LDI allocation, helping support their long-term environmental, social and governance (ESG) objectives. So let’s review the performance of this brand new asset class and consider the year ahead for green gilts.

Executive summary

£15 billion (bn) of green gilts issued in 2021 with maturity dates of 2033 and 2053.

New record set for day-one demand with large oversubscription in excess of 10x the issuance, resulting in strong price movements on the day.

Strong performance of green post-issuance but not all plain sailing. Some underperformance at year-end as short-term investors took profits.

We observe a lower 'greenium' (the difference in yield between the green gilt and equivalent traditional gilt) for the 2053 vs 2033 bond, signalling that pension scheme investors are either still grappling with how to incorporate green within their LDI solutions or are unwilling to overpay.

The current green issuance is not a liquid market and so we urge investors to act with caution when introducing green gilts into their investment strategy.

Giving the LDI manager flexibility to add green exposure as opportunities arise is likely to be more cost effective than a simple averaging-in approach.

Positive relative performance for green investors

Defining success for a financial instrument tends to be associated primarily with return. However, as these instruments have been in the market for less than six months, it’s clearly too early to draw meaningful conclusions. We therefore need to look beyond simple yield metrics.

Let’s have a look first at the demand observed on the day each green gilt was issued.

Green Gilt 2033

The first green gilt issued in September 2021 was a 12-year bond maturing in 2033. The total demand on the day was extremely high - in excess of £100bn for a £10bn issuance, the largest oversubscription in the history of the gilt market. This resulted in a very low average allocation for fund managers, well below usual standards. It’s therefore no surprise that the price performance on the day was extremely strong with a 3 basis points (bps) (0.03%) spread tightening.

Assessing the level of the greenium is going to be subjective as the Debt Management Office (DMO) decided to fill a gap with the 2033 green gilt, with no direct comparator. By analysing the yields on traditional gilts with a similar duration, we estimated an implied greenium of 2-3bps at the time of the issuance. This, plus the 3bps tightening on the day resulted in the green gilt trading very close to what we observe in Germany with the Bund greenium (around 5bps).

Green Gilt 2053

The second green gilt to follow a couple of weeks afterwards was the 2053. It also encountered very strong demand, in excess of £70bn for a final issuance of £5bn. The oversubscription was such that we received an even lower allocation than for the previous green gilt, setting another new record. As expected, the performance on the day was very strong too. However, it did not reach the levels experienced for the 2033 green gilt. This suggests a lower premium for long-dated green bonds compared with shorter maturities. It’s worth noting this is a pattern we also observe in Europe with German sovereign bonds, where longer-dated bonds trade with a 2bps greenium compared to 5bps for shorter maturities.

Performance since inception

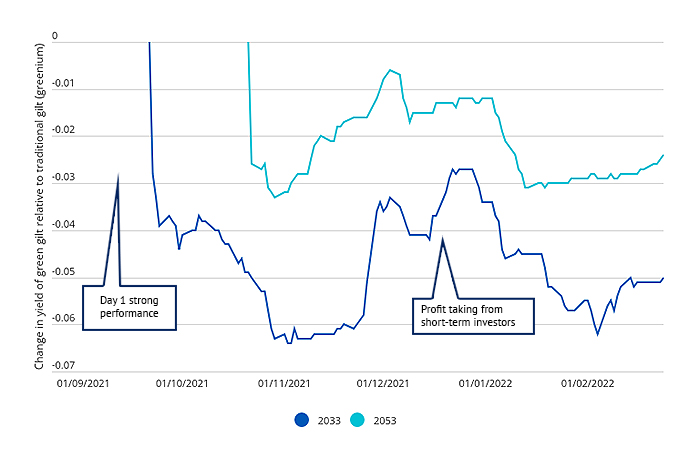

The chart below shows the change in the greenium post-issuance for both the 2033 and 2053 green gilt. The negative numbers reflect the fall in yield of the green gilt relative to the traditional gilt, which means positive overall performance of green post issuance.

Figure 1: Change in greenium post-issuance

Source: abrdn as at 28 February 2022. Past performance is not a guide to future results.

After the initial strong price reaction, the greenium was broadly aligned with levels observed in the more established German market. However, by the end of 2021 we saw profit-taking from short-term investors creating some underperformance and offsetting some of the gains observed in the first few weeks. By the end of February relative values came back to richer levels, with the greenium in excess of 5bps.

To summarise, this expected new sterling sovereign asset class broke many records including overall demand and immediate price movements. This is a great market testimony to the successful government ESG agenda.

Investors who secured these assets have benefited from a strong price move, but greenium volatility experienced at the end of 2021 indicates it’s not all plain sailing. Let’s take a look at some of the other considerations.

It’s not a liquid market

We need to acknowledge the very limited liquidity. With only £15bn of outstanding amount, this is less than 1% of the overall gilt market. Issuance schedule and market volatility can trigger some pricing dislocation as noticed in the UK and Germany by the end of 2021. An illiquid market can offer opportunities for tactical investors but can be a stumbling block for systematic-based strategies.

As such, we urge investors to act with caution when introducing green gilts into their investment strategy. A simple averaging-in over a number of months is likely to be sub-optimal and result in higher trading costs when liquidity is low on particular days. Giving the LDI manager more flexibility to add green exposure as opportunities arise is likely to be more cost effective.

LDI investors still grappling with the greenium

Given the lower greenium for the 2053 vs 2033, we believe pension scheme investors with demand for long-dated maturities are still grappling with the greenium concept for gilts and how to balance hedging and sustainability objectives.

We expect strong demand for green gilts from pension schemes as guidelines are updated.

Many pension clients are still considering what changes need to be made to investment objectives and mandate guidelines to ensure green gilts can be incorporated in portfolios without jeopardising the accuracy of the liability hedge. It’s still not clear what the green make-up of a typical LDI portfolio will look like in the future, but we expect strong demand for green gilts from pension schemes as guidelines are updated. Regulatory changes and new guidance from The Pensions Regulator, as well as views from the consultant community, could impact the speed at which green gilts are widely adopted.

It’s worth keeping an eye on regulatory developments outside of the pensions industry too. We know for instance that in Europe, beneficial capital treatment for ESG securities has been discussed for insurers. This would help balance conflicting objectives of return and green credentials, providing clear justification for the greenium. However, in practice this is more likely to impact risk assets than gilts.

What’s next?

Going forward, the DMO will have to balance conflicting objectives. On the one hand they want to build a curve and establish green gilts as a separate asset class, but liquidity concerns may result in a focus on increasing the issuance at a few key maturities first.

Conclusion

We are still at the beginning of the green gilt journey, but investors who were able to get their ducks in a row and participate from day one are unlikely to regret their decision. For a small premium paid at issuance, many pension schemes were able to take a small step in the right direction to help meet their sustainability objectives; and they also had the nice bonus of seeing markets move favourably, with their green gilt allocation outperforming an equivalent traditional gilt portfolio.

It may only be a few basis points of relative yield movements, but the outperformance indicates strong demand. This has the potential to increase further in the near term as more pension schemes make the necessary updates to mandate guidelines to allow green gilts within their LDI solutions.

Although still a relatively small market, over time and depending on the extent of further issuance in 2022 and beyond, we are hopeful that all schemes will be able to use their LDI allocation to help support the environment, while continuing to achieve their hedging objectives.